Now Your Institution Can Scale Securities-Based Lending

Securities-based lending (SBL) is an essential product for investors who want an attractive liquidity alternative. Does your institution struggle to scale your SBL business because of homegrown systems that do not address SBL’s unique characteristics with manual processes and frustrations for all? Don’t let your institution miss out. By adopting Supernova’s technology, you can more broadly provide your investors a streamlined SBL solution while leaving behind administrative hassles and time-consuming processes.

Help Your Investors and Advisors with Supernova’s Streamlined and Industry Leading Securities-Based Lending Technology

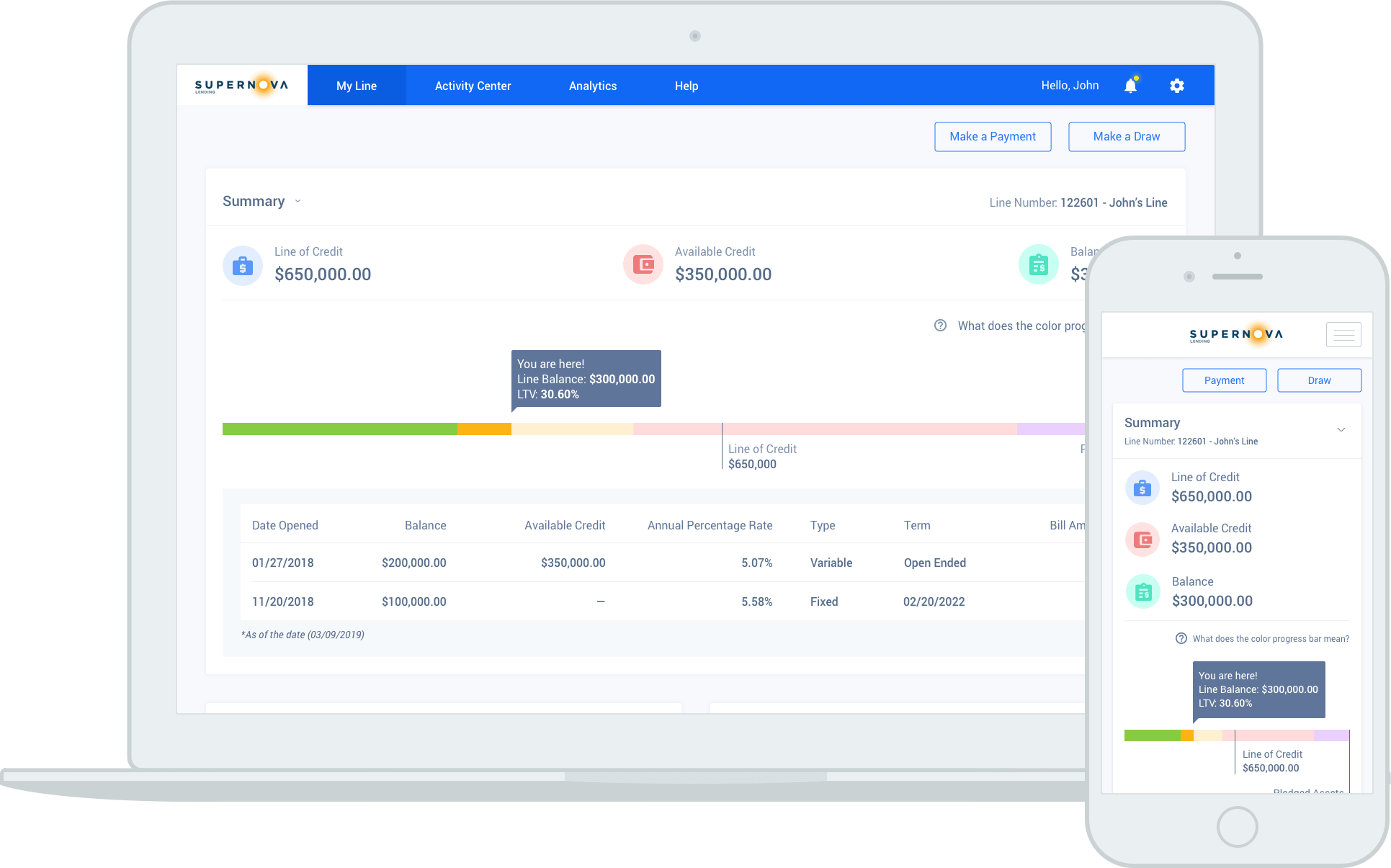

When you adopt Supernova’s enterprise software, each stage of the SBL loan process is digital, fast, and efficient and provides full transparency to loan details. Supernova’s cloud-based SaaS technology integrates real-time data from multiple systems and co-exists in harmony with institutions’ enterprise ecosystem. Our state-of-the-art modular architecture and suite of APIs make integration easy. Our clients have achieved remarkable results.

Investor Benefits:

- Streamlined process with digital proposal and application

- Rapid access to funds

- Improved line of credit utilization

- Full transparency to loan details

- Online servicing access

Institution and Advisor Benefits:

- Operational efficiency gains and cost reductions

- Improved SBL adoption and penetration

- Reduced effort to monitor collateral and mitigate risk

- Centralized reporting and analytics

HOW IT WORKS

Fund Loans

Securities-based lending is growing fast, and providing it will help you stay ahead of the curve. By joining our financial ecosystem, you’ll be provided with an opportunity to fund securities-based loans.

Technology & Service Solutions

Our educational content, tools and solutions are used by some of the largest financial services firms in the world. Our modular approach lets you easily customize our technology to meet the needs of your firm. Let us empower you with solutions for improved client and employee satisfaction and the potential to optimize return on equity.

87% - 99%

reduction in loan origination time*

$0

set up, maintenance or cancellation fees

20%

lower minimum line of credit

179%

increase in balances in 2020

*Assumes a fully integrated solution

faqs

Find answers to the questions we get asked the most.

-

What is a securities-based line of credit (“SBLOC”)? keyboard_arrow_right

An SBLOC is a low interest rate line of credit that allows investors to borrow against their taxable investment portfolio to address their financial needs.

-

Why an SBLOC? keyboard_arrow_right

An SBLOC allows clients to easily unleash the value of their investment portfolio by using the eligible assets as collateral. Whether they need funds to pay off student loans or to purchase a car, boat or anything other than additional securities, an SBLOC enables them to achieve financial wellness, without disrupting their financial goals and investment strategies.

-

What are the advantages of an SBLOC? keyboard_arrow_right

An SBLOC offers highly competitive pricing and access to liquidity. Clients can utilize multiple investment accounts as collateral and combine them into one line. There are no fees associated with the line and clients are only required to pay the interest monthly, provided the SBLOC is in good standing and there has not otherwise been a collateral call.

Explore Our Other Solutions