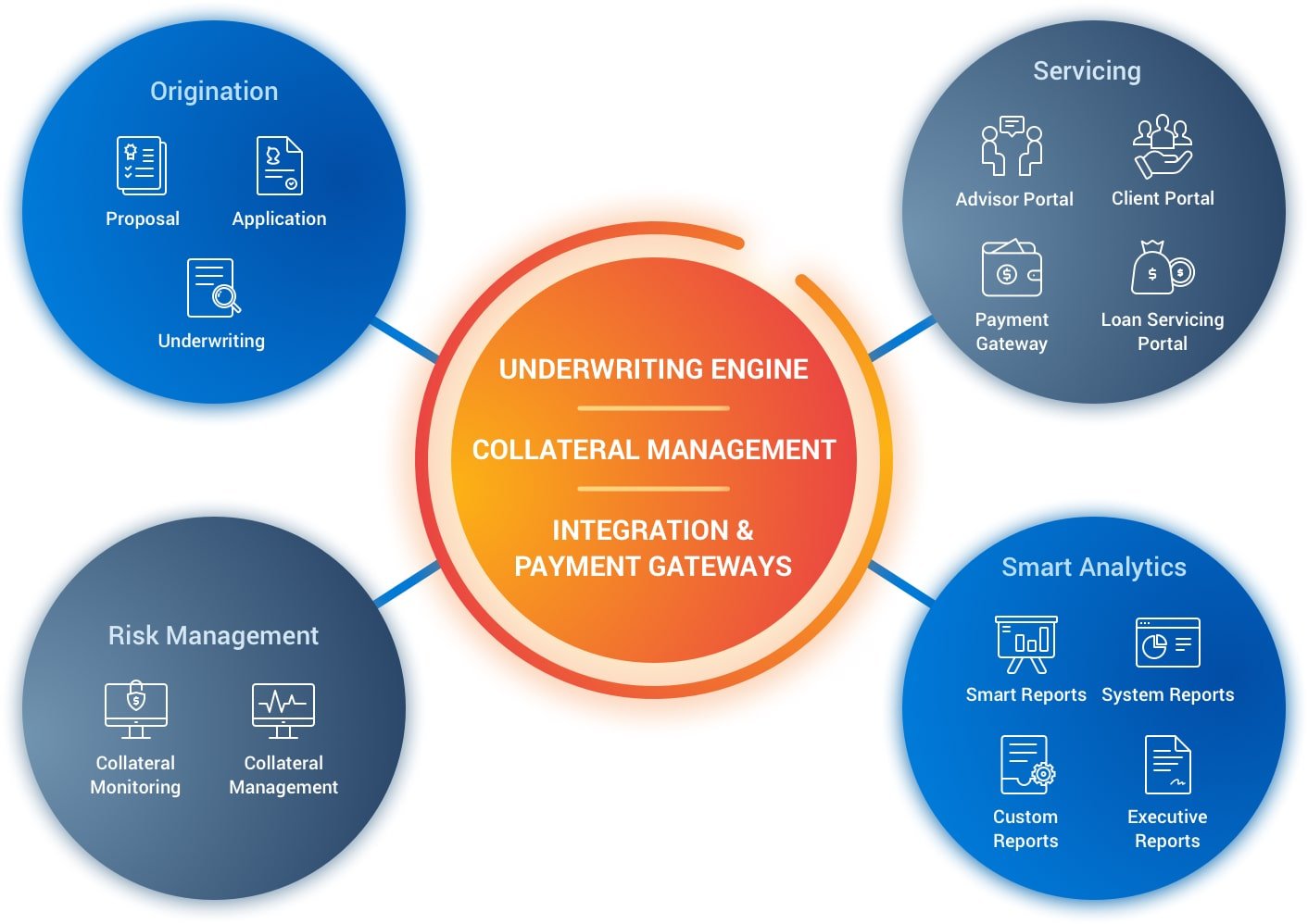

Platform Overview

Our cloud-based platform integrates real-time data from multiple systems, such as loan accounting, collateral monitoring, and payment processing, and applies intelligent permissioning across the integrated platform. The result is that all parties — borrowers, lenders, advisors and firms — can easily collaborate throughout the life of the loan, from origination and servicing to risk monitoring and repayment.

- A configurable solution puts you in control. Choose a turnkey, all-inclusive technology platform, or just the module(s) you need

- Flexible architecture for easy integration and adoption

- Mobile-friendly user interface

- Robust integration capabilities allow us to effortlessly connect with funding partners and other third parties, significantly reducing the time to bring SBLs to life

Our technology is designed to be a central operating system that withstands even the most demanding requirements of our partners. Recognizing that most financial services firms have existing infrastructures that must be used within our overall platform, our technology is built to enable rapid integration in approximately 3 months.

Supernova End-to-End Enterprise Technology

.svg)

Collateral Management

Reduce the operational risks associated with collateral management and provide stakeholders with transparent, on-demand and automated support.

- On-demand, real-time account portfolio evaluation for proposal generation

- Supports multiple credit policies, with exception override and edit capabilities

- Daily and real-time data fed into advisor and client portals enables accurate decisions and improved servicing

- Powerful data integration through API and data feeds with key participation systems delivers daily and on-demand mark-to-market pricing data

- Clean and comprehensive security master supports accurate calculation, referencing and analytics

.svg)

UNDERWRITING

Our underwriting module leverages technology to help digitize and automate labor-intensive tasks while providing a workflow tool that ensures each loan is decisioned appropriately.

- Configurable rules allow for semi-automated decisioning with final human review

- Loan details are pre-populated from credit policy

- Document presentation, storage and management and activity log with exception tracking

- Credit Reporting Agency and LexisNexis integration

- Robust Customer Identification Program

- Risk scoring, collateral evaluation and exception management

- Loan notes and supporting evidence collection

.svg)

INTEGRATION & PAYMENT GATEWAYS

With our easy-to-use payment gateway and deep integration with all necessary parties, it takes just a few clicks for clients to make payments and configure personalized settings, such as setting up one-time or recurring payments.

- Clients can easily request a draw or make a payment online without any confusion or difficulty

- Clients can keep track of future and previous payments and set up one-time payments or add recurring payment rules online in a centralized location

- Clients benefit from a streamlined and digitized customer experience

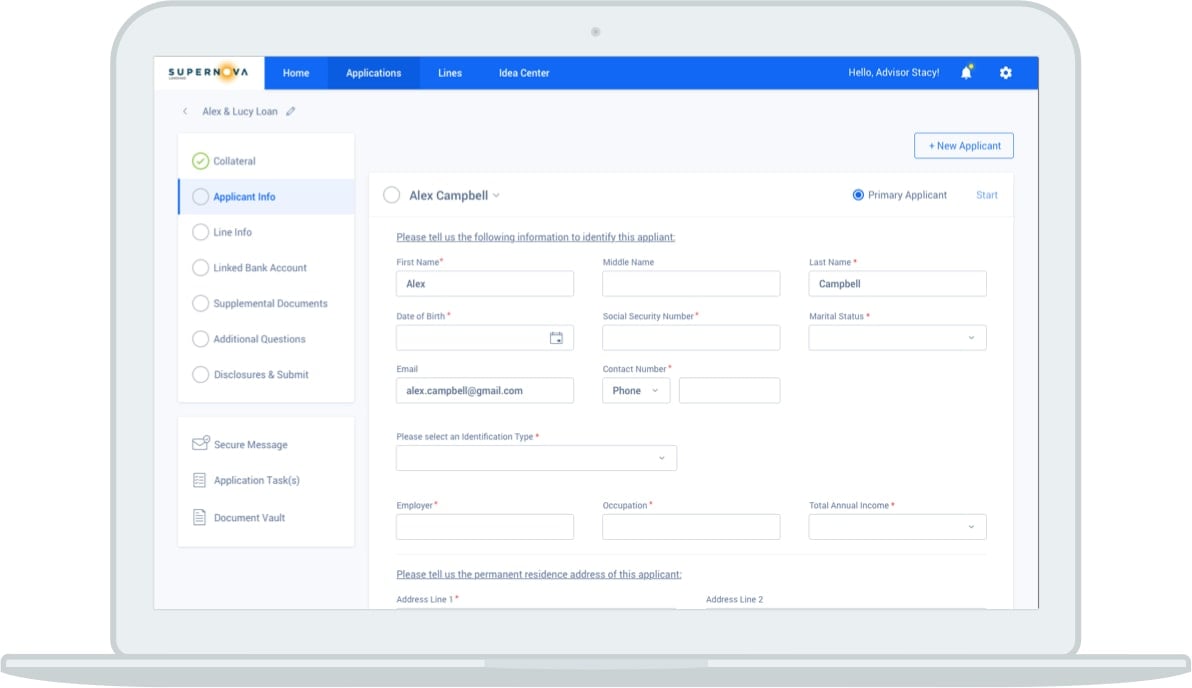

ORIGINATION PORTAL

A streamlined origination process means you can offer immediate liquidity for client liquidity needs when they need it. No more paperwork or waiting weeks for signatures. Clients apply online and, if qualified, can be approved in a matter of minutes.*

- All-electronic delivery, signature and closing*

- Online collaboration between lender, custodian, advisor and borrower

- Secure and reliable document storage

- Full audit trail and activity tracking

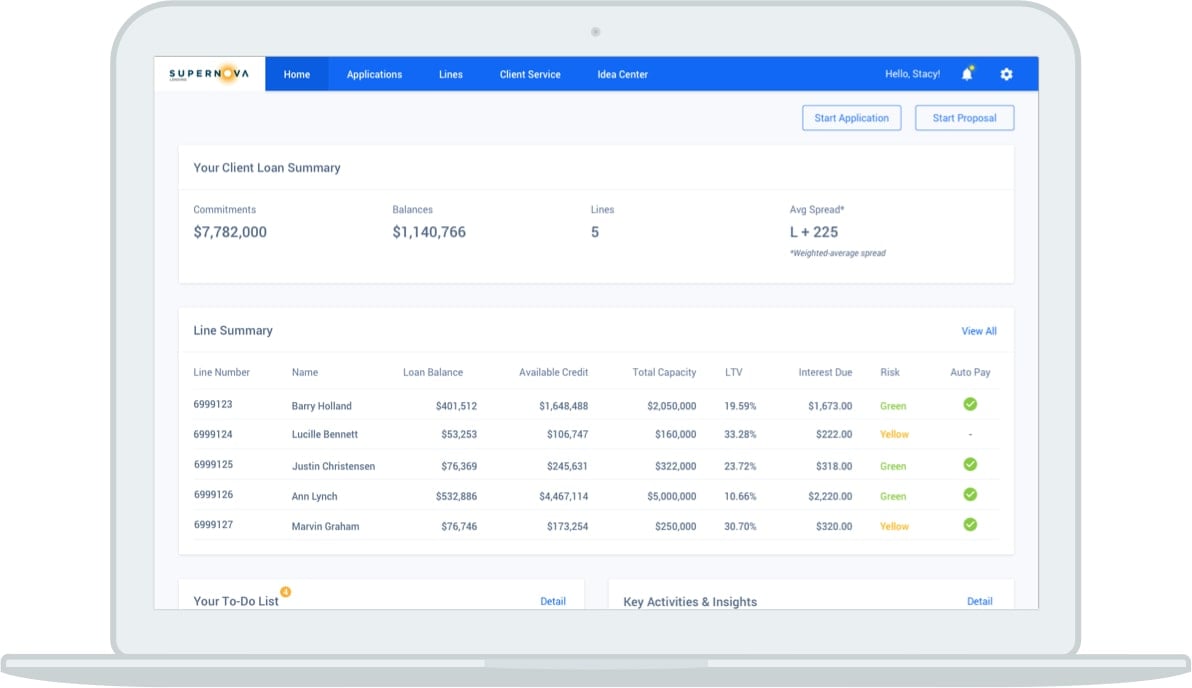

ADVISOR PORTAL

Designed for busy professionals, the advisor portal ensures a quick and frictionless experience — even for advisors who have no prior loan experience.

- Track application status

- View loan details for each client

- Monitor risk with an array of tools, including a color-coded risk radar and collateral values indicator

- Send and receive client communications

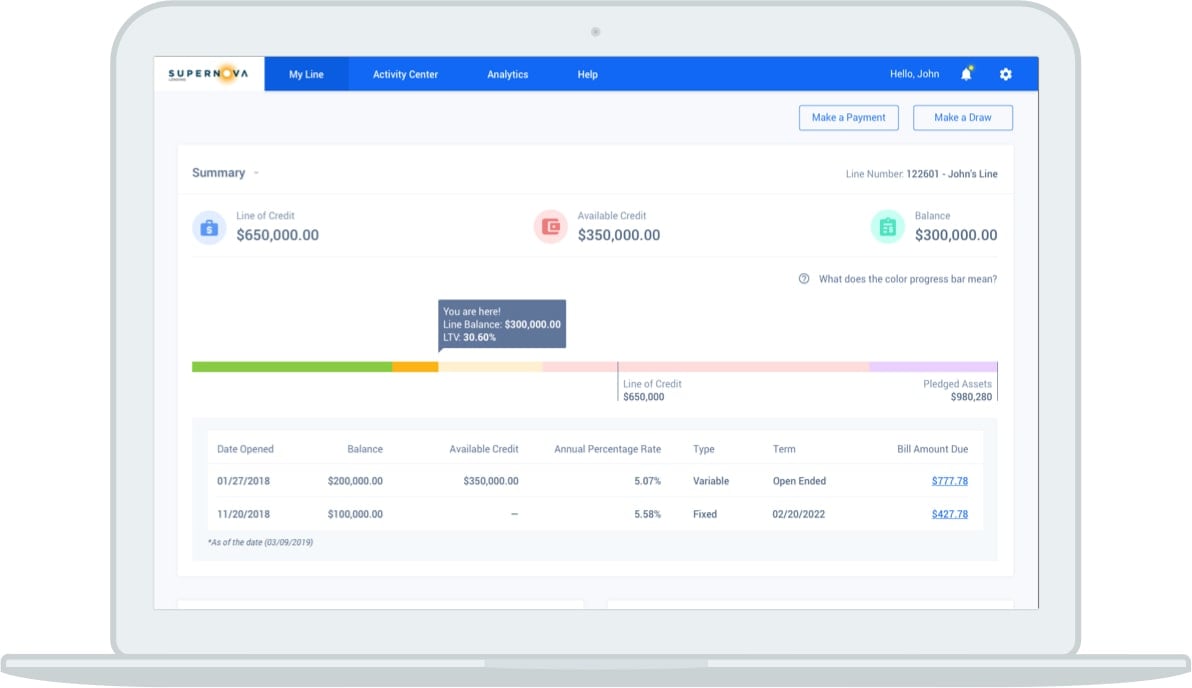

CLIENT PORTAL

Once a line of credit is approved, clients have access to an intuitive dashboard to stay abreast of the status of their accounts 24/7.

- View account information, including interest rates, balances and activity history for each line of credit

- Request draws and make payments

- Complete loan document retention and visibility

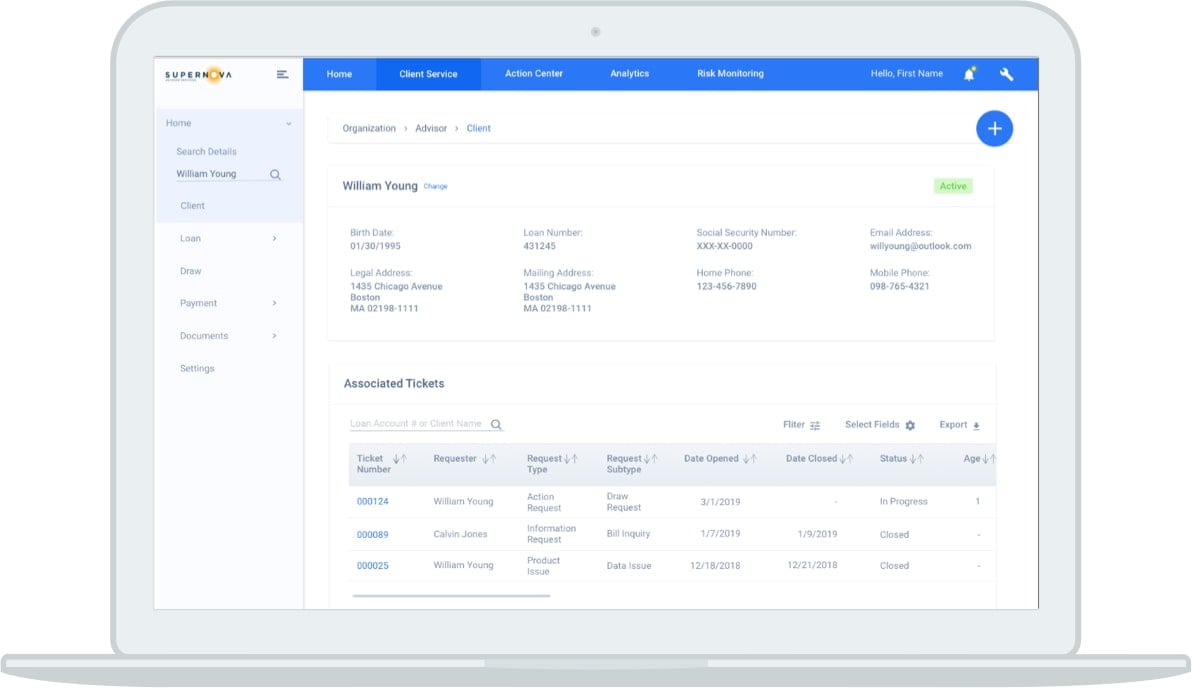

SERVICE PORTAL

All client and advisor data is aggregated in a service portal that facilitates online collaboration between the lender, custodian, advisor and borrower. Your team can get a complete picture of the firm’s overall loan portfolio and service each individual account.

- View lines of credit, margin, and disbursement information and make loan notes

- Open and close loans

- Upload, approve and store loan documents

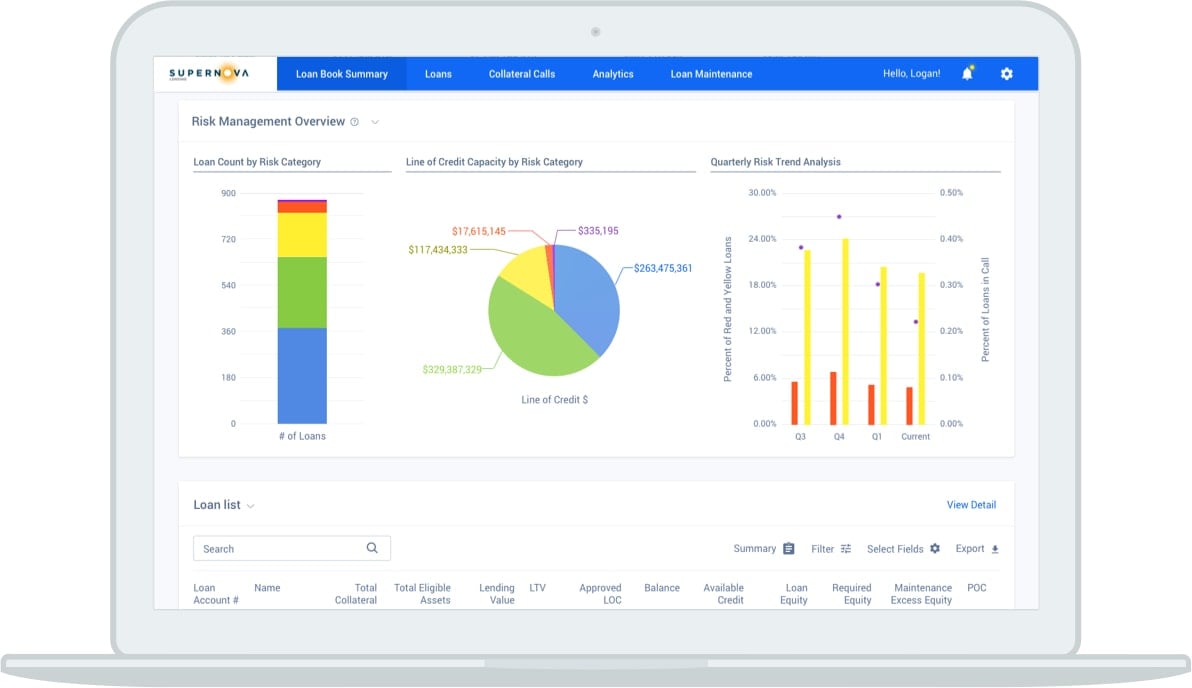

RISK MONITORING

Robust customized views and reports enable your advisors, your clients and your internal risk professionals to gain unprecedented visibility into risk.

- Daily collateral monitoring

- Rules-based collateral valuation engine

- Risk ratings based on predictive intelligence

- Streamlined collateral call management

- Dedicated compliance dashboard